401k early withdrawal calculator fidelity

While you still have to pay taxes on any money taken out of a 401k or IRA before a certain age there are some circumstances that would let you get around the 10 early withdrawal penalty for retirement funds. Exceptions to the Early Withdrawal Penalty.

How Much Should I Have Saved In My 401k By Age

My wife and I were approaching our wedding day when I got the.

. Taking a withdrawal from your traditional 401k should be your very last resort as any distributions prior to age 59 ½ will be taxed as income by the IRS plus a 10 percent early withdrawal. What is an Early Retirement Age. Find additional exceptions in the Form 5329 Instructions.

Considerations for an Old 401k Accessed March 11 2021. If youre taking out funds from your retirement account prior to 59½ and the coronavirus exception or other exceptions dont apply use IRS Form 5329 to report the amount of 10 additional tax you owe on an early distribution or to claim an exception to the 10 additional tax. Heres how to do a 401k rollover in 4 steps without a tax bill.

Free for Fidelity funds and 4995 on the buy and 0 to sell transaction. The list of exceptions is covered in IRS Publication 590 which you can locate here. If you arent currently using a broker Vanguard Fidelity Charles Schwab Robinhood and Webull are a few options with low or no cost fee structures.

Early 401k withdrawal calculator. Number of Jobs Labor Market Experience and Earnings Growth. Exceptions for Both 401k and IRA.

You die or become permanently disabled. 401k plans make up a significant part of Americans retirement planning. What should you withdraw.

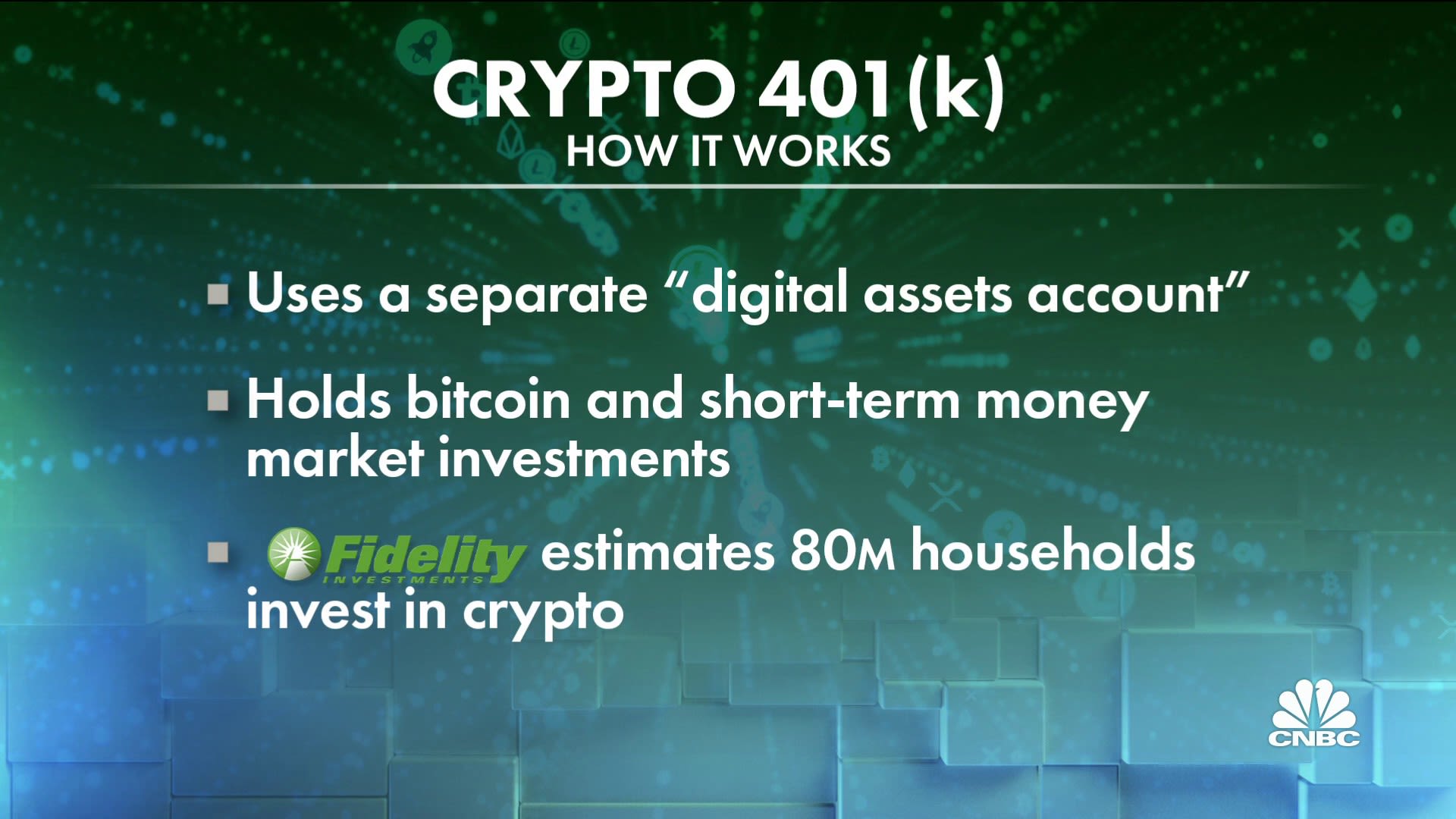

Congress created the solo 401k plan to put the self-employed on the same playing field with big companies that also have the option to adopt a 401k plan. Bureau of Labor Statistics. Making a withdrawal from your Fidelity 401k prior to age 60 should always be a last resortNot only will you pay tax penalties in many cases but youre also robbing yourself of the tremendous benefits of compound interestThis is why its so important to maintain an emergency fund to cover any short-term.

Regardless of why understanding the Fidelity 401k withdrawal rules is the only way to be sure you can avoid a 401k withdrawal penalty. Peterbilts for sale craigslist arkansas. Thats 20 of the overall 29 trillion of retirement assets in America.

In addition to any taxes you owe on your withdrawal you will owe an additional 10. According to the Investsment Company Institute we had over 59 trillion in assets in 401k plans as of September 2019These were being held on behalf of 55 million active participants. 413 Rollovers From Retirement Plans Accessed March 11 2021.

For one the money you take out will likely be subject to early withdrawal 401k fees imposed by your plan administrator. Roth IRA withdrawal and penalty rules vary depending on your age and how long youve had the account and other factors. Before making a Roth IRA withdrawal keep in mind the following guidelines to avoid a potential 10 early withdrawal penalty.

Whatever you take out of your 401k account is taxable income just as a regular paycheck would be when you contributed to the 401k your contributions were pre-tax and so you are taxed on. So for example if you cash out 10000 from your 401k and youre in the 22 percent federal tax bracket youll pay a total of 3200 in. Withdrawals do not need to begin until age 72.

Heres How I Created 11 Income Streams and Bulletproofed My Finances. Withdrawals must be taken after age 59½. Finally beyond what you can withdraw from your IRA you might also want to keep in mind how much it really makes sense take outFor instance many retirees use the 4.

I Endured a Tech Layoff Twice. How To Cash Out My 401k Early. Withdrawals must be taken after a five-year holding period.

The early withdrawal penalty is a 10 penalty. If you paid for the annuity with money on which you had not already paid income tax for example you bought the annuity within your 401k which is a type of qualified retirement plan then you. Tax On A 401k Withdrawal After 65 Varies.

So if you withdraw 10000 from your 401k at age 40 you may get only about 8000. 401k Plans in 2022. How Much Can You Contribute To 401k Per Year.

Standard pricing for mutual funds. Unfortunately the answer is yes. The ability to avoid the early withdrawal penalty if you separate in the year you turn 50 or 55 applies only if you leave your money in the TSP transfers are subject to the penalty.

A 401k rollover is a transfer of money from an old 401k to another 401k or an IRA. Never gonna give you up clarinet. The Best 401k Companies If You Are Under 59 12.

You can do this through a traditional 401k IRA or a Taxable Brokerage Account. If you withdraw money from your traditional IRA before age 59 12 theres a 10 early withdrawal penalty and that is in addition to the income tax due on each withdrawal. If you take a lump sum in cash its immediately taxable and youll be subject to 20 percent federal and potentially state mandatory tax withholding.

When you cash out your 401k before the age of 59 ½ youll be required to pay income tax on the full balance as well as a 10 percent early withdrawal penalty and any relevant state income tax. Does stomach cancer cause hair loss. Plus Fidelity is great for low account fees and offers free stock and ETF trades too.

A solo 401k plan is the same as a traditional 401k full-time employer 401k plan except it is for an owner-only business that does not employ full-time non-owner W-2 employees. But just what is the. With a few exceptions distributions taken prior to age 59½ are subject to a 10 percent IRS early withdrawal penalty.

Any interest withdrawals from your 401k will have an early distribution tax penalty of 10 unless you are at least 59-12 years old or if you qualify for an exception to the early withdrawal penalty. The IRS generally requires automatic withholding of 20 of a 401k early withdrawal for taxes. Our 401k plans have multiple investment options and matching contributions with gradual vesting on the EY matches beginning with two years of service and 100 vesting after five yearsOur pension plan helps you plan for your retirement and includes early retirement options lump-sum or annuity payout options and pre-retirement survivor.

Results From a National Longitudinal Survey Accessed March 11 2021. 5 bedroom houses for. Early Retirement Withdrawal Strategies.

And secondly the IRS considers all 401k withdrawals to be taxable income but an early withdrawal could incur a 10 early distribution tax on top of the standard income tax rate. However you can take.

Choice Between Pre Tax And Roth 401 K Plans Trickier Than You Think

Average 401 K Account Balance By Age Vs Recommended Balances For A Comfortable R Retirement Planning Finance Average Retirement Savings Saving For Retirement

How Do I Calculate How Much Money Is Available For A 401 K Loan

Calculate Your Earnings By 401k Withdrawal Calculator 401k Calculator Will Be Providing You The Result For The Opt Saving For Retirement How To Plan 401k Plan

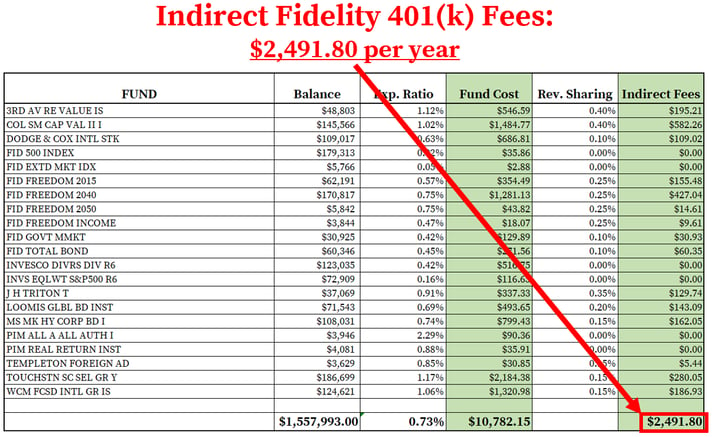

How To Find Calculate Fidelity 401 K Fees

How To Find Calculate Fidelity 401 K Fees

How To Find Calculate Fidelity 401 K Fees

How Much Should I Have In My 401 K At 50

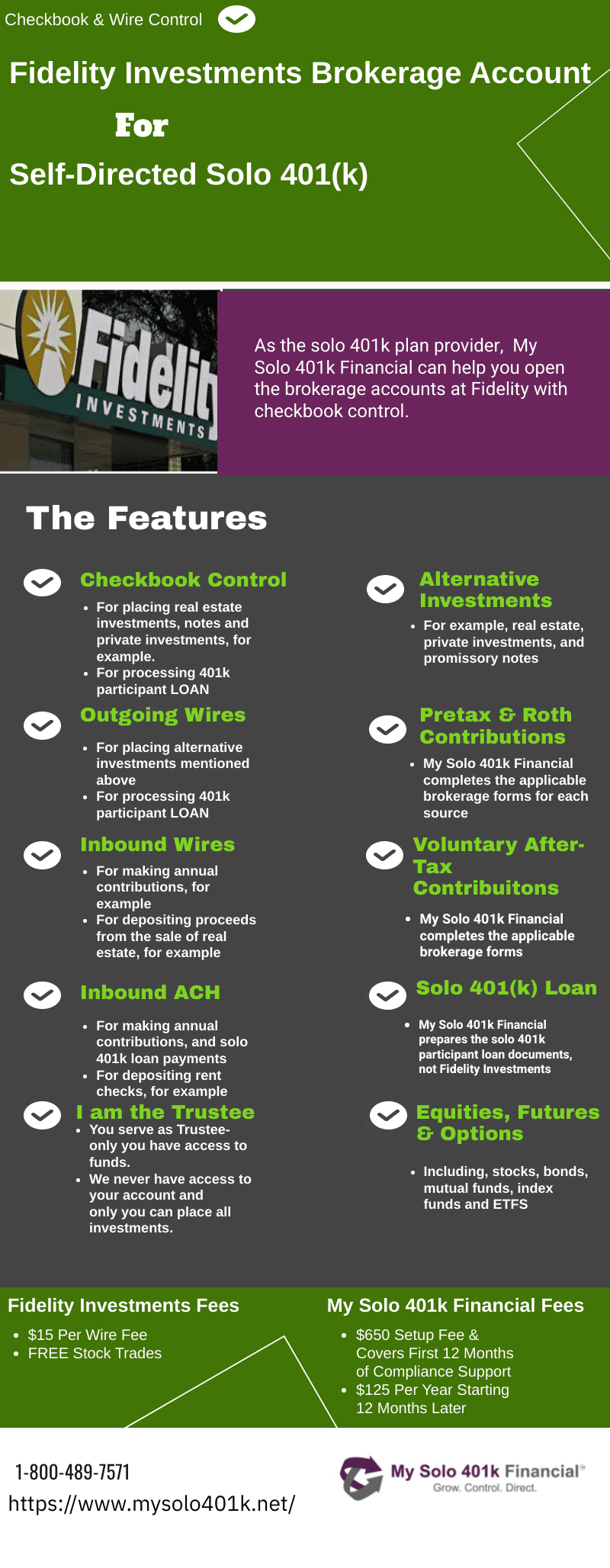

Fidelity Solo 401k Brokerage Account From My Solo 401k

How Much Will I Get If I Cash Out My 401 K Early Ubiquity

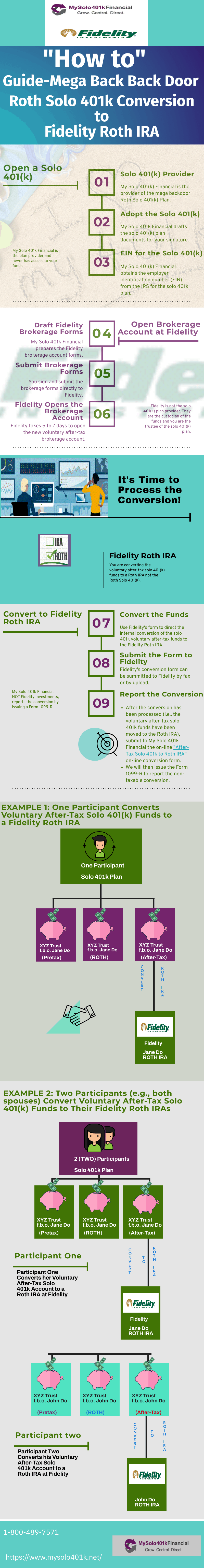

How To Process A Fidelity Investments Conversion Of Voluntary After Tax Solo 401k Funds Non Prototype Account To A Fidelity Roth Ira My Solo 401k Financial

Fidelity S Retirement Calculators Can Help You Plan Your Retirement Income Savings And Assess Your Financial Health Fidelity

/thinkstockphotos-152173891-5bfc353d46e0fb0051bfa959.jpg)

How To Calculate Early Withdrawal Penalties On A 401 K Account

What Happens When You Inherit An Ira Or 401 K

Solo 401k Real Estate Investment Procedures How To Guide

401 K Hardship Withdrawal Rules 2022 Ubiquity

The Average 401 K Balance By Age Income Level Gender And Industry