36+ Florida Homestead Exemption Calculator

File Online for Homestead Exemption. Before buying real estate property be.

How To Lower Your Property Taxes If You Bought A Home In Florida

If the assessed value is lower than 75000 the additional homestead.

. If you have built on an addition or made renovations to your homestead property to provide living quarters for one or more natural or adoptive parents or grandparents then you may be eligible. The maximum portability benefit that can be transferred is 500000. Per Florida Statute 196041 2 A person who otherwise qualifies by the required residence for the homestead tax exemption provided in s.

Florida Property Tax Calculator - SmartAsset Website Just Now The end result is that the homestead exemption reduces assessed value by 25000 for school taxes and by 50000. For example if you sell your homestead property at any time during 2022 the. Heres a breakdown of four common property tax exemptions.

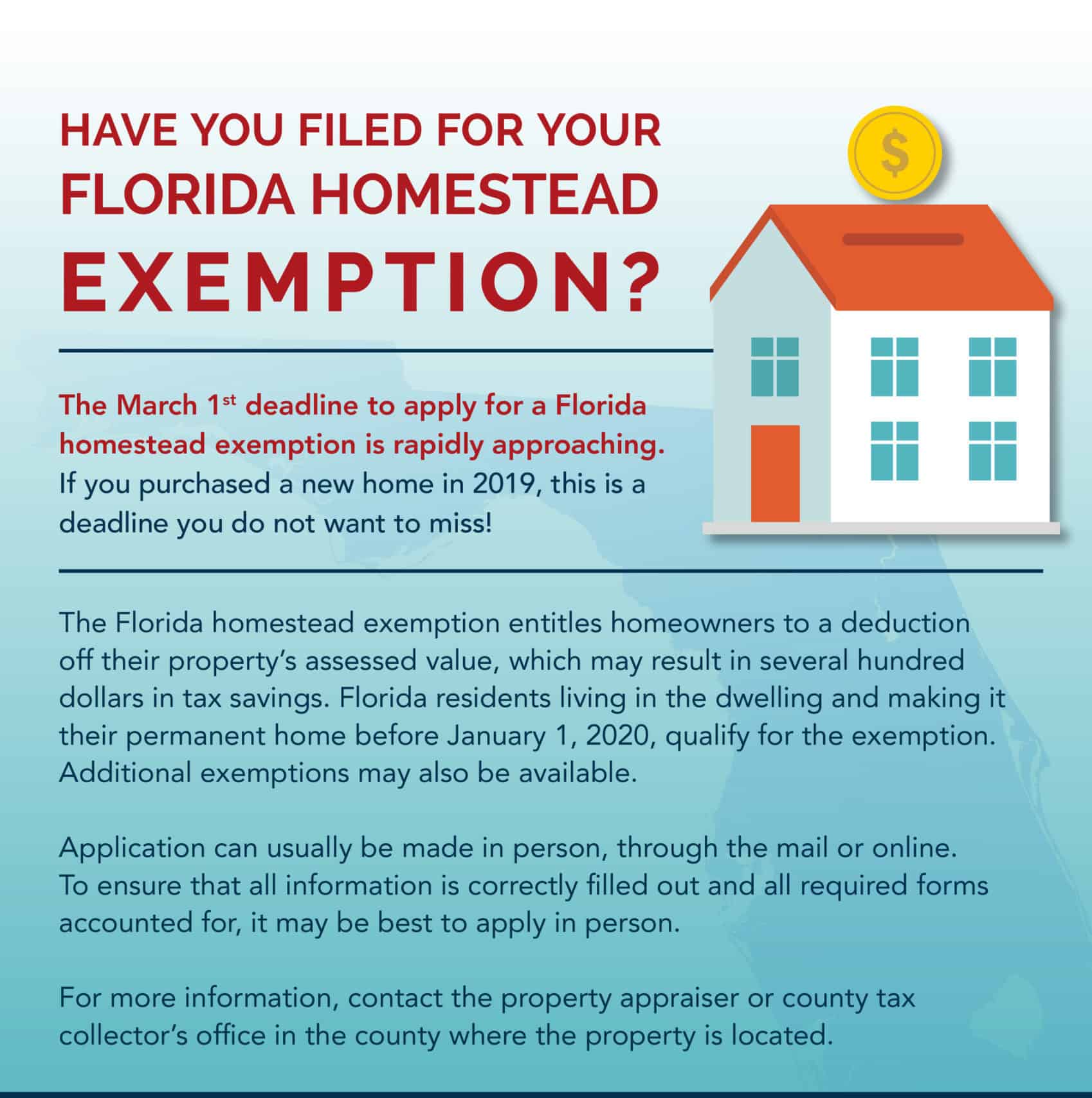

The Homestead Exemption saves property owners thousands of dollars each year. Homestead Exemption Save Our Homes Assessment Limitation and Portability Transfer When someone owns property and makes it his or her permanent residence or the permanent. Suite 101 Stuart FL 34994.

Florida Property Tax Calculator Estimate My Florida Property Tax Estimate Property Tax Our Florida Property Tax Calculator can estimate your property taxes based on similar properties. The Florida Homestead Exemption is as of January 1st. Most states and counties include.

Homestead Exemption Calculator - Commissioner James Noack Montgomery County precinct 3 Montgomery County Homestead Exemption Calculator Your Homes Appraised Value. Homestead exemption provides a tax exemption up to 50000 for persons who are permanent residents of the State of Florida who hold legal or equitable title to the real property and who. 196031 shall be entitled to such exemption where.

3473 SE Willoughby Blvd. Each January 1st counts as a tax year. Do not jeopardize your Homestead by renting your property.

This estimator assumes that the application for the new homestead is made within 2 years of January 1st of the year the. To receive the full additional 25000 homestead exemption the propertys assessed value must be at least 75000. Once you determine the amount of the homestead exemption figuring out your property taxes is a matter of subtracting the amount of the homestead exemption from your.

9419 Plaza Park Missouri City Tx 77459 Zerodown

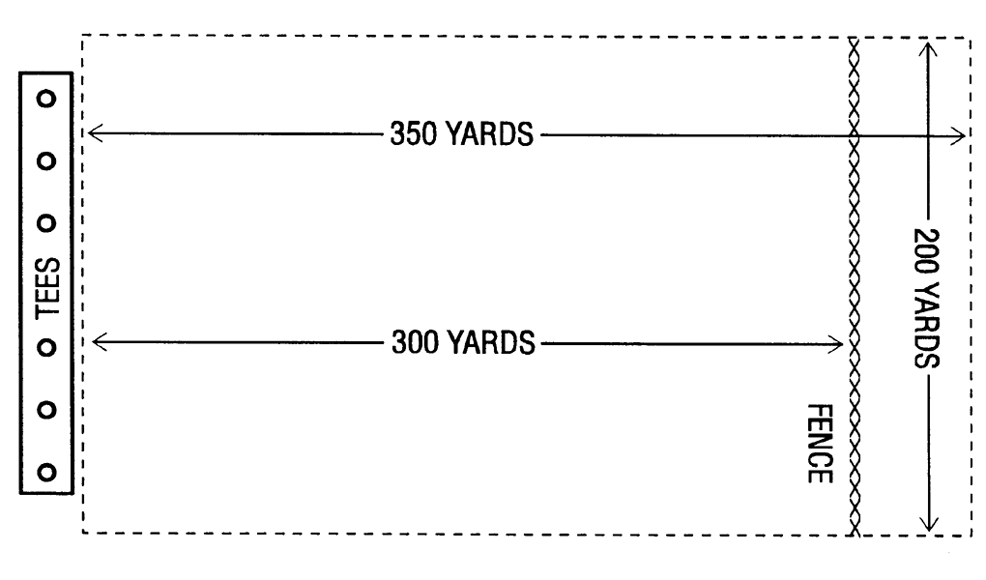

Chapter B Zoning Ordinance Unified Development Code Clemmons Nc Municode Library

Winston Mortgage Payment Calculator Florida Homestead Check

How To Apply For A Homestead Exemption In Florida 15 Steps

How To File For The Homestead Tax Exemption Property Tax Tallahassee

Florida Property Tax Calculator Smartasset

Chapter B Zoning Ordinance Unified Development Code Clemmons Nc Municode Library

Florida Homestead Exemptions Emerald Coast Title Services

Homestead Exemption And Portability Parkland Boca Raton Coral Springs

Florida Homestead Exemptions Emerald Coast Title Services

Homestead Exemption Amount In Florida Ask The Instructor Youtube

Martin County Property Appraiser Property Tax Estimator

3910 Dewalt Manor Missouri City Tx 77459 Zerodown

![]()

Winston Mortgage Payment Calculator Florida Homestead Check

Calculate Florida Homestead Property Taxes Ask The Instructor Youtube

What Is Homestead Exemption Find Houston Homes

Hernando County Property Appraiser